Summary

ARC Resources' Kakwa acquisition boosts production by 40,000 BOE/D and enhances its liquids exposure, supporting long-term growth in the Montney.

Attachie Phase One delivered its first full quarter of production in Q1 2025. Despite early issues, ARC reaffirmed full-year guidance.

My base case DCF values ARC at US$29.46 per share post-acquisition, with the deal accretive by an estimated US$0.99 per share before synergies.

Key risks include commodity price volatility, Canadian regulatory changes, and FX exposure.

Investment Thesis

I maintain a bullish outlook on ARC Resources (OTCPK:AETUF) (TSX:ARX:CA), supported by company-specific catalysts and expected longer-term macro tailwinds. The recently announced acquisition of Strathcona’s (OTCPK:STHRF) (SCR:CA) Kakwa assets adds to one of ARC's core areas without materially stressing the balance sheet. I believe the deal is accretive even before factoring in potential synergies. ARC’s first quarter 2025 results reflected operational issues at Attachie, but production from the asset remained solid. The company is working to address the emulsion issue and reaffirmed its full-year guidance.

ARC provides a balanced production mix of natural gas and liquids, and I remain positive on the outlook for both natural gas and liquids through the remainder of the decade. I expect that the upcoming increase in North American LNG export capacity will begin to close the gap in global natural gas pricing. For condensate, the recent fears due to trade uncertainty and the potential for recession have pressured pricing. However, I maintain the view that U.S. shale is maturing and will find it difficult to see incremental growth if capital budgets experience sustained reductions. In addition, I believe that there has been persistent underinvestment in large-scale developments with lower base decline. Both of these factors support my long-term positive outlook.

Company Overview

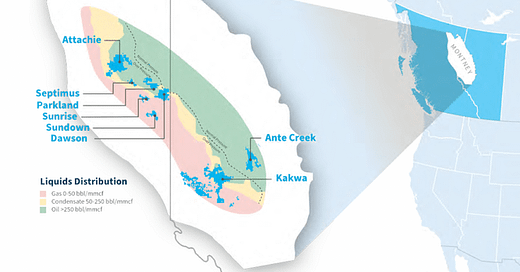

ARC Resources began in 1996 as an energy trust by acquiring assets from Mobil Oil Canada. It first entered the Montney in 2000 by acquiring Ante Creek assets from Suncor, and grew its position with the addition of the Dawson field from Star Oil and Gas in 2003. In 2005, the company was the first to drill a horizontal well in the Montney.

ARC entered its self-proclaimed ARC 2.0 phase in 2011 when they converted from a royalty trust to a conventional E&P company in response to regulatory changes. Their merger with Seven Generations Energy in 2021 included significant Kakwa acreage and formed what is now referred to as ARC 3.0 by the company.

ARC currently produces over 370,000 barrels of oil equivalent per day (BOE/D), with a product mix of 63% natural gas, 25% oil and condensate, and 12% natural gas liquids (NGLs).

Montney Focused

ARC is solely focused on the Montney, and it holds over one million net acres in the play. Montney wells are drilled horizontally and completed using hydraulic fracturing. The production profile is characterized by high initial rates, followed by steep declines that flatten into the tail. There are multiple targets in the Montney that allow for more efficient land development, and ARC focuses primarily on the liquids-rich portion of the play.

Attachie: First Full Quarter of Production

The first quarter of 2025 marked the first full period of production from Phase One of Attachie. With full-year 2025 volumes expected to average approximately 35,000 BOE/D, Phase One represents a key driver of ARC’s near-term production growth. A second phase is planned to support incremental growth later in the decade.

Attachie encountered early operational challenges. The facility experienced downtime in March and April due to emulsion issues. The company is optimizing its chemical treatment strategy and continues to expect full-year volumes to be in line with guidance.

Capital investment for Phase Two is scheduled to begin in 2026, with first production targeted for 2028.

Kakwa: Strathcona Asset Acquisition

ARC Resources recently entered into an agreement to acquire Strathcona’s Kakwa assets that are located adjacent to ARC’s existing position on the eastern side of the play. The cash transaction is valued at approximately C$1.6 billion. It has an effective date of April 1, 2025, and it is expected to close in July.

Prior to the acquisition, Kakwa already accounted for approximately 45% of ARC's production and 50% of its land base. The acquisition is expected to add approximately 40,000 BOE/D with a production mix of 50% liquids and 50% natural gas. ARC will also acquire two plants and an interest in a third, which supports its low-cost structure.

ARC is financing the transaction with a new C$1.0 billion two-year term loan alongside its existing credit facility. Pro forma net debt is expected to total approximately C$2.8 billion, resulting in a Net Debt-to-EBITDA (TTM) ratio of 0.86x.

In my base case DCF, and excluding any realized synergies, I estimate the acquisition to be accretive by roughly US$0.99 per share.

Valuation

I estimate a base case fair value of US$29.46 per share for ARC Resources following the Kakwa acquisition, using a five-year discounted cash flow (DCF) model. 2025 production is modeled using the midpoint of company guidance at 387,500 BOE/D plus an additional 38,000 BOE/D from the acquisition. This includes a 5% safety factor below the approximate 40,000 BOE/D disclosed. The model assumes a 6% compound annual growth rate in production thereafter, consistent with ARC’s historical production per share growth. The assumed production over the five-year period is 870.9 million BOE.

Estimated revenue of US$30.5 billion was derived using a regression analysis of ARC’s historical realized pricing relative to benchmark pricing. Assumed benchmark prices reflect a five-year average of US$75/bbl for oil and US$4.75/MMBtu for natural gas. Unit operating costs were based on historical values and are included in the table below.

Cash flow of US$10.3 billion was calculated by subtracting cash operating expenses and income taxes (US$19.5 billion), capital expenditures (US$7.6 billion), and adding back non-cash expenses (US$6.9 billion). Capital expenditures were modeled at 25% of revenue based on historic values. This cash flow was discounted to the present at approximately US$8.0 billion using a 10% weighted average cost of capital (WACC).

A terminal value was calculated at US$18.6 billion by applying a 6.0 EV/EBITDA (TTM) multiple to the final year EBITDA of US$3.1 billion, providing a terminal present value of US$11.2 billion.

The enterprise value of the sum of the present value of cash flow and the terminal value resulted in US$19.2 billion, and the equity value was $US17.2 billion after I adjusted for net debt. Using an assumed share count of 585.0 million provided my fair value of US$29.46 per share.

To account for commodity price volatility, I also calculated DCF scenarios for a low and high case. The table below shows the key assumptions for all three scenarios.

While I view the base case as the most probable due to my average commodity price assumptions, the results of the low and high cases in the table below show the valuation impact of sustained commodity prices in either extreme.

Risks

Revenue for E&P companies is closely tied to commodity prices. Hedging reduces downside volatility but also caps upside during favorable price environments. Regulatory risk remains a key consideration, with potential impacts ranging from cost inflation to operational delays. Hydraulic fracturing faces potential regulatory challenges in addition to risks related to water usage rights, waste disposal restrictions, and seismicity.

ARC’s operations are entirely concentrated in Canada, and this increases sensitivity to regional regulatory and infrastructure developments. The company also faces foreign exchange risk due to revenues primarily being denominated in U.S. dollars and costs being largely in Canadian dollars.

Conclusion

ARC Resources continues to execute well across a concentrated, high-quality asset base in the Montney. The Kakwa acquisition enhances its position without overstretching the balance sheet, and Attachie remains on track despite initial challenges. With balanced exposure to natural gas and liquids, ARC is well-positioned to deliver attractive returns. My base case supports a fair value of US$29.46 per share.

Disclaimer: The content here is for informational purposes only and does not constitute investment advice. All views are my own. Full disclaimer available here.